Any Willing Provider Laws

Benefit Payment Schedule

Benefits

Claims Review

Covered Service (Covered Benefit)

Indemnity Plan

Participating Provider

Point-Of-Service Plan (Pos)

PORTAL-OF-ENTRY PROVIDER

Preexisting Condition Exclusion

Third-Party Payer

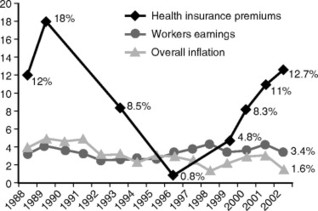

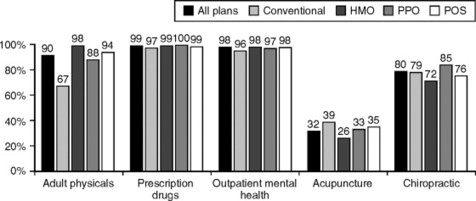

Managed care includes a variety of methods that the health insurance industry uses in an effort to decrease the cost of health care and, secondarily, to increase its quality. In the United States during the early 1990s, managed care was touted as the cure for spiraling health insurance premiums, which were escalating by as much as 18%1 (Fig. 29-1). Managed care has partially achieved its goals, providing some benefits to providers, patients, and shareholders and now appears to be a permanent part of the health care landscape in the United States. For the chiropractic profession, however, managed care has largely failed to reproduce the level of success it recorded in conventional allopathic health care. As of 2002, between 72% and 85% of American workers insured under managed care programs had coverage for chiropractic services2 (Fig. 29-2). However, the extent and quality of that coverage varies widely. Chiropractors need to understand the managed care landscape to make well-informed decisions regarding participation in managed care plans.

|

| Fig. 29-1 The drop in the rate of increase for health insurance premiums, leading to its low in mid-1996, was a result of the spread of managed care. (From The New York Times, September 6, 2001.) |

|

| Fig. 29-2 Percentage of U.S. workers covered for selected benefits, by plan type, 2002. (From NCMIC Managed Care Overview, November-December 2002, with permission.) |

HISTORICAL PERSPECTIVE

Managed care dates back to the turn of the twentieth century. The first managed care organizations (MCOs) were prepaid group practices, conceived and created by medical physicians. These organizations accounted for only a minuscule portion of medical care delivery and, in most cases, did not account for the majority of physicians’ practices. Patients insured through MCOs paid a predetermined periodic fee in exchange for access to all necessary medical care.

As sociologist Paul Starr described in his landmark book, The Social Transformation of American Medicine, 3 members of labor unions and food cooperatives founded many early experiments in prepaid group practice programs. With the notable exception of the Group Health Cooperative of Puget Sound, most of these programs were financially too weak to survive. Crucial to the development of broad-based managed care was the program that industrialist Henry Kaiser initiated in the 1930s for the workers at his west coast shipyards and steel mills. When World War II ended and the number of workers in the Kaiser plants declined, the Kaiser-Permanente health plans were opened to the public. These programs eventually grew to be far larger than their parent company.

Kaiser’s goal, Starr writes, was to “reorganize medical care on a self-sufficient basis, independent of the government, to provide millions of Americans with prepaid and comprehensive services at prices they could afford.” The Kaiser-Permanente program was a physician-operated health maintenance organization (HMO) that pioneered the staff model in which physicians are salaried employees of the HMO, and the economic incentives of private practice (in which increased services produce increased income) are eliminated. This model has the advantage of substantially decreasing overutilization of health services; conversely, it can have the disadvantage of encouraging underutilization whereby needed services may not always be provided.

After almost a century of direct involvement in the managed care process, allopathic medicine has secured a central role within managed health care. The same cannot be said for the chiropractic profession. Chiropractic, a relatively young profession today, was far less developed in the first half of the twentieth century. (One half of the chiropractors practicing today graduated within the last 10 years.) In the 1930s, when managed care was beginning, the profession was ill prepared to develop managed care strategies such as prepaid groups, much less grow them into huge corporate insurance entities such as Kaiser-Permanente; nor were any chiropractors invited to participate in medical managed care organizations, until many decades later.

As a result, managed care and the chiropractic profession had very little to do with each other until the late 1980s. Chiropractic grew rapidly through the 1970s and 1980s, enjoying significantly increased public recognition and improved interprofessional relationships. A decade or more of third-party reimbursement of chiropractic services (through fee-for-service insurance policies, automobile accident coverage, and worker’s compensation plans) was beginning to foster a new sense of belonging and security in a profession that had long existed at the fringes of the health care industry. When chiropractors were first invited to participate in managed care on a large scale in the early 1990s, many practitioners eagerly joined. However, with rare exceptions, the profession was offered little meaningful input in developing managed care policy.

By the mid to late 1980s, managed care had evolved into a primarily corporate entity. About all that remained for full corporatization was purchasing and managing individual practitioners’ practices, which for medical practices has proceeded at a rapid pace in recent years.

Allowed amount: Maximum charge permitted for a procedure under a health insurance policy.

Annual cap: Predetermined maximal amount payable by an insurance plan for a particular service within 1 calendar year. Many insurance policies have annual caps on spinal adjustment/manipulation or on chiropractic services.

Benefits: Services or goods covered under an insurance policy.

Benefit payment schedule: List of amounts an insurance plan will pay for covered health goods or services.

Complementary and alternative medicine (CAM): Health care interventions not taught widely in medical schools or generally available in hospitals. Under this definition, chiropractic is considered part of CAM.

Claim: Bill for services rendered that is submitted to a health benefit plan for payment.

Co-insurance: Percentage of the allowed amount of medically necessary services, which is paid by the patient to the provider after the annual deductible has been satisfied.

Co-payment: Flat dollar amount paid to the provider by the patient at each visit.

Covered service (covered benefit): Medically necessary procedures within the practitioner’s scope of practice that are covered under the patient’s health care insurance policy. Covered service is also called covered benefit.

Deductible: Flat out-of-pocket dollar amount that the patient must pay each year to providers before the insurer will pay for any covered benefits.

Direct access: Ability to consult a health care practitioner without a referral from a primary care physician.

Discount plan: Insurance arrangement under which the provider discounts the normal fee (usually by 20% to 30%). The patient pays the entire discounted fee, and the insurance company makes no payment to the provider. Discount plan is also known as access plan or affinity plan.

Stay updated, free articles. Join our Telegram channel

Full access? Get Clinical Tree